Please note the view expressed in this post are those of the member posting and not necessarily of the BBGA

After a busy 2017, Tony Whitty, Managing Director at Air Partner, comments on what the Group’s Remarketing team is currently seeing in the regional airliner market, with further details on specific models below.

“Over the last few years, we have remarketed several different types of regional aircraft, including E195s, E170s, E145s, ATR72s, DHC8s and CRJs. In recent years, new lessors have arrived in this sector in significant numbers. The influential players, such as Nordic Aviation Capital, Falko and Avmax, own large numbers of a range of aircraft types, and so airlines no longer need to worry about arranging finance to acquire regional models.”

REGIONAL AIRCRAFT MARKET APPRAISAL

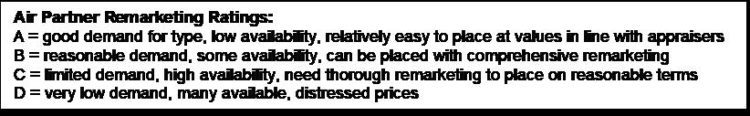

ATRs: Air Partner Rating C+

- Oversupply of new ATR72-600s from the manufacturer to lessors

- -600 lease rates dropped 60,000 USD in last two years

- Newer ATR72-500s dropping in value by 10+% per annum

- -200s and older -500s attractive for freight conversion

- Fedex order for up to 50 ATR72-600s and Silver Air’s firm order for 20 ATR42-600s are significant

DHC8s: Air Partner Rating C+

- Orders continue but for small numbers of Q400 aircraft (the only remaining production model)

- Many used Q400s been on the market for 1+ years

- -100/200/300s still niche STOL (short take-off and landing) aircraft types that have very limited competition but they are getting old

E-Jets: Air Partner Rating B-

- E145s trading well in used market but at low values – 70 operators worldwide

- E175 popular in USA

- E170 a niche aircraft – where will the Saudia aircraft end up?

- Ex-TACA, Flybe, Borajet, Kalstar and Air Canada E190s and E195s proving slow to place. Very attractive manufacturer and/or export finance for new orders hurts the market for newer used aircraft

- Several E170s and E190s have been parted out

CRJs: Air Partner Rating C+

- CRJ200 values holding above appraisers’ values

- CRJ200 cargo conversions steady

- CRJ700 very niche but USA-dominated due to scope clause

- CRJ900 – successful USA aircraft

- CRJ1000 – only four operators

Fokker 50: Air Partner Rating B-

- Niche aeroplane with concern over support

- Good value, rugged construction – only four advertised for sale

- Freighter conversions in limited numbers – expensive conversion cost

Fokker 70/100: Air Partner Rating B

- Operator base has moved from Europe with many aircraft going to Australia and Papua New Guinea

- Good value with great cabin that is still relevant

- New operators in market, e.g. Tus, Air Niugini and Alliance Airlines (40)

- Low capital cost ideal for low utilisation flying

- Readily available green-time engines

Saab 340/Saab 2000: Air Partner Rating C+

- Only around 60 S2000s built – largely been a European operated aircraft

- Competition from ATR, CRJ200 and E145 restricted S2000 sales

- Nearly 400 S340s built initially, with sales success in the USA with AMR Eagle

- Good used market activity over the years with Rex Australia now operating 52 S340s

- Ultimately the S340 has been replaced with 50 seat aircraft with better operating economics

MA60/MA700: Air Partner Rating C-

- 108 MA60s have been delivered to 26 operators in 18 countries

- 185 orders for the MA700 by 11 operators – deliveries scheduled to start in 2021

- Poor safety record

- Attractive pricing and financing likely to be key to the success to date

- Interesting in comparison to where the manufacturers of the Sukhoi Superjet, C Series and MRJ currently stand in terms of operator base, orders and geographical penetration

Air Partner’s Aircraft Remarketing division has got 2018 off to a strong start, announcing last week the sale of a 2009-vintage Beechcraft King Air 200 on behalf of Air HH Luftverkehrsgesellschaft mbH Privat Jets. This transaction follows a successful 2017, in which the division won and fulfilled a number of mandates. Notable transactions included the sale and delivery of a third Kenya Airways B777-200ER aircraft to Omni Air International; the sale of two B747-400s to Jet Midwest Group on behalf of China Airlines; and the sale of two of Kenya Airways’ B737-700 aircraft, which were then leased back to Kenya Airways for continued operation. The team was also appointed by Saudi Arabian Airlines as its exclusive remarketing agent in respect of 15 Boeing 777-200ERs. It currently has a number of other mandates on a variety of aircraft, including a B787, several ERJ145s and an ATR72-500.

ENDS

Enquiries:

| TB Cardew | T. +44 (0)20 7930 0777 | |

| Tom Allison | M. +44 (0)7789 998 020 | |

| Alycia MacAskill | M. +44 (0)7876 222 703 |

About Air Partner Remarketing Services

Air Partner Remarketing Services is a specialist aircraft remarketing agent which acts for airlines and other aircraft owners, such as banks, operating lessors, manufacturers, insolvency practitioners and high net worth Individuals, to dispose of their surplus aircraft including commercial jets, turboprops, helicopters or private jets, either by arranging a sale or lease of the aircraft. It also advises clients on the acquisition of aircraft and their fleet management process. Former and current clients have included Cyprus Airways, Kenya Airways, China Airlines, Saudia, Flybe, British Midland, Cargolux, Daimler-Chrysler, KLM, DVB Bank, Halifax Bank of Scotland, Investec Bank and Rolls-Royce Aircraft Management. www.airpartner.com/en/our-services/remarketing

About Air Partner

Founded in 1961, Air Partner is a global aviation services group that provides worldwide solutions to industry, commerce, governments and private individuals. The Group has two divisions: Broking division, comprising air charter broking and remarketing; and the Consulting & Training division, comprising the aviation safety consultancies, Baines Simmons, Clockwork Research and SafeSkys, as well as Air Partner’s Emergency Planning Division. For reporting purposes, the Group is structured into four divisions: Commercial Jets, Private Jets, Freight (Broking) and Consulting & Training (Baines Simmons, Clockwork Research, SafeSkys and Air Partner’s Emergency Planning Division). The Commercial Jet division charters large airliners to move groups of any size. Air Partner Remarketing, which is within the Commercial Jet division, provides comprehensive remarketing programmes for all types of commercial and corporate aircraft to a wide range of international clients. Private Jets offers the Company’s unique pre-paid JetCard scheme and on-demand charter. Freight charters aircraft of every size to fly almost any cargo anywhere, at any time. Baines Simmons is a world leader in aviation safety consulting specialising in aviation regulation, compliance and safety management. Clockwork Research is a leading fatigue risk management consultancy. SafeSkys is a leading Environmental and Air Traffic Control services provider to UK and International airports. Air Partner is headquartered alongside Gatwick airport in the UK. Air Partner operates 24/7 year-round and has 20 offices globally. Air Partner is listed on the London Stock Exchange (AIR) and is ISO 9001:2008 compliant for commercial airline and private jet solutions worldwide. www.airpartner.com

Lucy Featherstone

Senior Account Executive

TB Cardew, 5 Chancery Lane, London EC4A 1BL

Telephone: +44 (0)20 7930 0777

Mobile: +44 (0)7789 374 663

lucy.featherstone@tbcardew.com

London | Johannesburg